Investors who want to increase their wealth can find many chances in the Indian stock market. On the other hand, creating a successful investment portfolio necessitates a strategic approach, meticulous preparation, and ongoing effort. Regardless of whether you are new to investing or have been doing it for a long time, having a solid understanding of the basics will help you achieve financial success in the long run.

1. Get a Clear Picture of Your Financial Objectives:

Before you start investing in the stock market, take a moment to think about what your financial goals are. Are you investing in order to achieve a specific goal, such as purchasing a home, or are you doing so for short-term profits or retirement? Having clear goals will assist you in determining the types of investments to include in your investing portfolio and will guarantee that your strategy is in line with your aims.

2. Select the Appropriate Trading Platform:

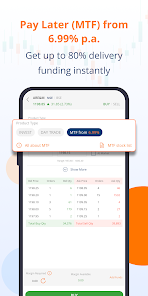

Choosing a trustworthy trading platform is one of the most important steps you will take on your financial path. A good platform has a smooth user experience, complete market data, and strong security features. Search for systems that provide advanced tools, market data, and assistance with a variety of investing possibilities.

3. Utilise an Indian trading application:

Investing with an Indian trading app has never been easier due to the advancement of technology. These applications provide features such as real-time market updates, simple transactions, and tools for stock analysis. Apps like Zerodha, Groww, and others make it easier to keep track of and manage your investments, regardless of whether you are a novice or an experienced investor.

4. Create a Demat Account:

In order to trade in the stock market, you must first register a Demat account. This account serves as a digital storage space for your shares. HDFC Bank and many other banks and financial organisations provide a smooth and easy account opening process. A Demat account allows for safe and efficient transactions and eliminates the need for real share certificates.

5. Use the Indian Stock Market App to gain insights:

You can obtain important market insights, news, and statistics by using an Indian stock market app. These apps feature tools such as stock screeners, trend analysis, and financial reports, which allow you to make decisions based on accurate information. It is easy to stay up to date with features like portfolio tracking and immediate alerts.

6. Partner with HDFC Bank for Your Investment Needs:

HDFC Bank provides a variety of financial services, such as the option to open Demat account and access integrated trading services. HDFC Bank may be a solid partner for you as you invest, thanks to its dependable customer assistance and modern digital banking capabilities.

7. Be patient and disciplined:

It takes time to accumulate riches in the stock market; it does not happen immediately. Stick to your approach and do not make hasty decisions based on temporary changes in the market. Investing in a consistent and disciplined manner will produce the best rewards in the long run.

Conclusion:

In order to create a successful investing portfolio in the Indian stock market, you need the correct tools, a strategic strategy, and a commitment to ongoing education. To be successful, it is important to use a strong trading platform or Indian trading app, register a Demat account, and stay up to date on the latest information.

Institutions such as HDFC Bank offer the assistance and resources necessary to make your journey more efficient. If you are patient and have a well-diversified portfolio, you can reach your long-term financial goals while taking advantage of the chances that the ever-changing Indian stock market provides.