Today’s digital environment makes borrowing money easier than ever. Getting a loan no longer requires long bank lines, tedious paperwork, and weeks of waiting. Due to technology, personal loan apps have made credit access faster, simpler, and online. Understanding how and why these applications are popular is crucial if you’re seeking a loan. Learn all about Indian personal loan apps in this guide.

What is A Personal Loan App?

A smartphone app called a personal loan app lets users borrow money fast and easily. These apps offer collateral-free loans instantly. Download the app to apply for a loan online, upload papers, and get approval in minutes. Nationwide, banks, NBFCs, and fintech startups offer these platforms. Best bit? Nothing is in an office—it’s all online.

Why Are Indian Personal Loan Apps Popular?

Mobile lending app platforms’ quickness and ease have made them popular in India. Increased internet prevalence and smartphone usage allow paid professionals, students, gig workers, and small business owners to access funds in a few taps. This is useful in crises or for persons without typical financial services. Unlike traditional lenders, a money lending app avoid paperwork, meetings, and extensive verification processes. Therefore, mobile apps are gradually replacing previous lending techniques.

How Do Personal Loan Apps Work?

User must download a mobile loan app from the app store and register with personal information to use it. This involves filling out a form, submitting ID and income verification, and choosing a loan amount and repayment duration. After the online loan application, the app verifies eligibility in real time using automated processes. The borrower’s bank account receives the funds within minutes or hours of approval. Repaying the loan in installments during the stipulated period is monitored in the app.

Advantages of Mobile Loan Apps

Instant acceptance is one of the benefits of mobile loan apps. Most apps make choices rapidly without manual inspections using AI-based underwriting. These platforms also offer variable loan amounts and repayment terms for different income levels. The greatest Indian loan apps are also user-friendly for beginners. The experience is smooth and trustworthy because many offer real-time loan tracking, automated reminders, and customer assistance.

Know the Best Indian Loan Apps

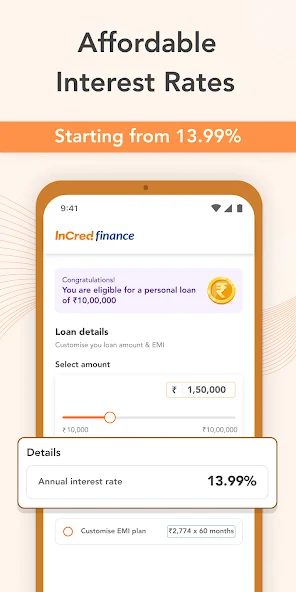

These days, numerous Indian lending app companies offer slightly distinct services. KreditBee, Navi, MoneyTap, CASHe, and Fibe (previously EarlySalary) are widely trusted in 2025. Low borrowing rates, transparent conditions, and rapid disbursal make these apps popular. Avoid hidden fees, data misuse, and predatory lending by using a trusted money lending app. Always compare interest rates, user reviews, and eligibility restrictions across applications before applying.

Security of Money Lending Apps

New users worry about money lending app safety. Most registered apps obey RBI or NBFC requirements, so download from trusted sources. A safe personal loan app will encrypt your data, clearly display interest rates and costs, and never request access to your device or contacts.

Warning Signs

Borrowers should be vigilant despite the convenience of use. Mobile loan apps may levy exorbitant interest or penalize delays. If undisciplined, borrowing can become a cycle. Avoid surprises by reading the fine print in your online loan application. If a lender isn’t upfront or presses you to borrow more, search elsewhere. Using a personal loan app properly requires responsible borrowing.

Conclusion:

Overall, a personal loan app is one of the fastest methods to get money in the digital age. These apps are improving Indian borrowing with speedier approval, flexible repayment, and improved user experience. A trustworthy money lending app can help you pay medical costs, college fees, or unexpected bills immediately. The correct Indian loan app, careful reading of the terms, and borrowing exactly what you need will help you stay financially healthy and stress-free.